Consider the story-

In an organization, a finance professional named “Emily” was glancing at the mountain of invoices on her desk. Moments later, she shifted her sight from the invoices to her productivity and observed that the whole day had been utilized exclusively on reconciliations, data entry, and approvals chasing.

With disappointment, she turned to her colleague. “Mark, have you noticed we’ve already spent two full days this week just tracking approvals on accounts payable?” Emily asked.

Mark exhaled. “Yeah! and vendors keep calling about late payments. It feels like our work is just limited to payments and approvals.”

Emily sat straight in her chair. “This isn’t sustainable. We cannot achieve our departmental goals working like this.”

Curious, Mark asked, “Have you come across anything that works better?”

Emily nodded. “Yes. I’ve been researching accounts payable automation services for months. These services streamline everything like-

- Capturing invoices automatically

- Routing them for approvals

- Scheduling payments on time

Just imagine if half this manual work disappeared.”

Mark remarked. “So instead of re-keying data and sending endless follow-up emails, we could actually analyze spend patterns and support the CFO with insights?”

Emily smiled. “Exactly. We wouldn’t be buried in transactions anymore. We’d finally become real business partners. And with real-time visibility into invoices and cash flow, leadership would get the transparency they need.”

With the calculations running through her mind, Emily concluded, “It’s clear – we need accounts payable automation to future-proof how finance operates. And we need to convince our CFO at any cost.”

The above scenario isn’t new. It is happening in many organizations where finance teams are seeking transformation and change.

If you find yourself in a role similar to Emily’s, this business case will help you convince your CFO to invest in an automated accounts payable system.

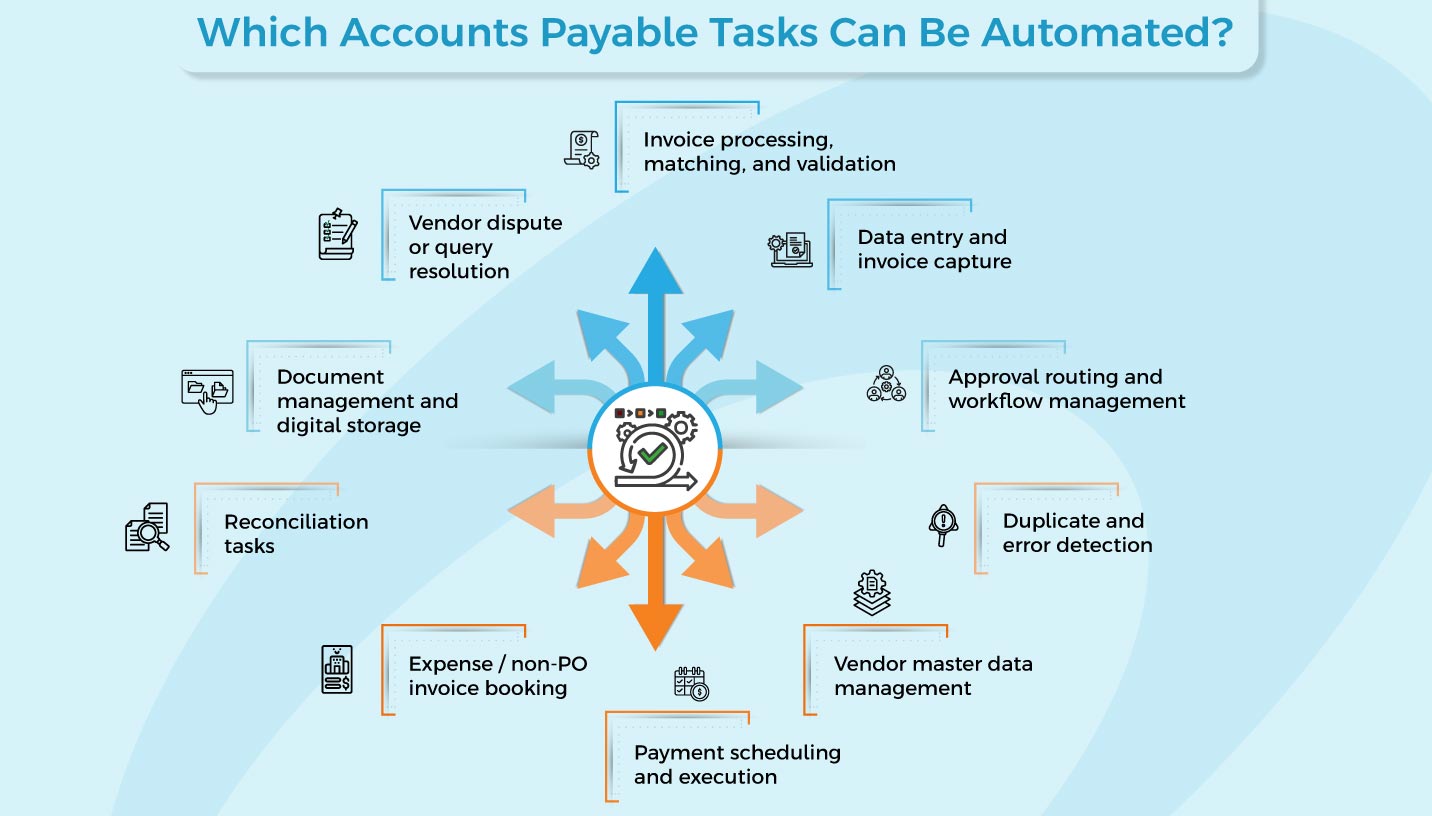

You might be wondering how this automation will actually work. Check out the infographic below- it speaks for itself.

From invoice capture to record keeping & compliance, everything is covered under this. Feeling excited and thinking about where to start?

It’s simple.

First, just draw the attention of your boss to the endless challenges in the traditional accounts payable system, and then take him to the automated accounts payable services.

Which Hidden Accounts Payable Challenges Are Draining Your Budget & Energy?

When you brief the CFO, begin by highlighting current issues you are facing and, then frame them around key elements like budget and workflow. This will help you present a strong case.

But initially, you need to study the key areas where the finance team is hampered.

Challenge 1- Invoice Processing & Approvals Eating Team’s Time

Manual invoice entry into the accounting system can completely exhaust your team, as the process is highly repetitive. And what about the mistakes you might make unintentionally with this manual setup?

They are more than you might imagine!

The issue doesn’t end here. When an invoice goes through many hands, waiting for managers to review and approve, bottlenecks creep in. By the time it gets approved, payments are delayed, and vendors keep calling continuously.

Another major issue is nothing but the inconsistent process across departments. Some teams submit invoices one way, while others follow a completely different approach. This inconsistency adds layers of confusion, delaying workflows.

It shows the necessity of accounts payable invoice automation to streamline data entry, approvals, and standardize processes across the board.

Challenge 2- Human Errors Causing Duplicate Payments or Incorrect Entries

Sometimes you get confused and ask your team, “Did we already pay this vendor last week?” Amid the turmoil, you start double-checking the records and realize the same invoice has been processed twice.

The downside? This has happened many times before.

When the team is fully loaded with invoices, it’s an easy target for data entry mistakes. Elements like a single typo, a missing digit, or incorrect coding led to more chaos and more mistakes.

What will happen if mistakes start affecting reporting as well?

You work hard to prepare clean and reliable reports, but when the data itself paints a confusing picture, how will it suggest actionable insights correctly?

If reporting isn’t accurate, the decision will have to rely on guesswork.

Ultimately, whether bigger or smaller, every mistake hampers your time, money, and trust. And that gives you the second major reason to convince your senior management to adopt automated accounts payable solutions to prevent duplicate payments and keep financial reporting sharp and reliable.

Challenge 3- Paper-based Workflows Climbing Operational Overhead

Did you ever grapple with lots of paper invoices just to get the information you want?

If you are finding it challenging even after spending enough money on storing, printing, and retrieving these papers, then your workflow needs attention.

The reason is simple- filing, searching, and re-filing documents takes countless hours of your team’s time. Sometimes it feels like half the budget goes into managing paperwork instead of driving financial strategy. And you’re not alone- many organizations face the same struggle.

But the sad part is this- boxes of invoices stacked in storage and reams of paper consumed every week also take a toll on the environment.

That means a double loss- financial and ecological. Searching for an answer?

It’s simple and clear- accounts payable process automation. These solutions dramatically cut these expenses by

- Digitized workflows

- Eliminated paper handling

- Reduced manual labor

- Attained sustainability goals

Challenge 4- Limited Visibility into Cash Flow, Outstanding Liabilities, and Vendor Performance

A meeting becomes fruitful when participants discuss real-time, reliable data.

But what if the data you are using isn’t trustworthy?

Outdated data + lack of visibility = Financial blind spots

To strengthen the vendor relationships, you need to be very serious with your data as well as the decisions you are making with that.

Vendors might get hurt if-

- Payments are delayed due to bottlenecks

- There’s no transparency into invoice statuses

The right accounts payable workflow automation addresses these issues by upholding vendor trust while empowering leadership with accurate, reliable insights.

The above pain points help you show the current gaps where your organization can be better. With these four points, you already have half the case built to convince your boss.

What’s next? Only putting challenges won’t be sufficient. CFOs are particularly interested in the possible benefits.

Hence, you first need to understand the transformative advantage the organization will reap from this automated approach.

Cost Benefits of Accounts Payable Automation for End-to-End Finance Process

Automation, if implemented smartly, can yield benefits beyond what anyone could expect.

Specifically, accounts payable automation acts as an intelligent decision maker, a rapid processor, and ensures accurate data generation. Look at these benefits for a comprehensive understanding-

Benefit 1- Reduced Labor and Administrative Costs

Research says that processing a single manual invoice costs around $ 7.75. With AP automation in place, the same invoice can be settled for just $ 2.02.

It means you are saving three times. Now, imagine the overall savings on all the invoices.

In addition to this, accounts payable invoice automation can reduce the time utilized per invoice to as low as five minutes. This allows the finance team to

- Focus on analysis and strategic initiatives

- Hire strategic thinkers and not followers

Benefit 2- Reduced Late Payment Fees and Early Payment Discounts

Vendors sometimes offer early payment discounts that are beneficial for both the vendor and your company.

However, to take advantage of these offers, you need faster approvals from higher authorities. With accounts payable workflow automation-

- You can avail these discounts on time

- Reduce late payment penalty charges

- Boost vendor relationships like never before

Simply, prompt payments save money and boost trust, leaving vendors excited to offer more profitable terms.

Benefit 3- Minimized Errors and Fraud-related Losses

Accounts payable automation can validate invoices against purchase orders and receipts. It remarkably minimizes errors.

That shows you no longer have to be worried about reconciling erroneous payments or other major mistakes. Going one step ahead, automation assists you in minimizing the risk of fraud with-

- Built-in multi-step approvals

- Segregation of duties

Last but not least, with automation backing your processes, you can attend audit meetings with enriched confidence. Every transaction is documented with a searchable audit trail, providing senior officials with real-time, reliable data and making compliance effortless.

Benefit 4- Eliminated Paper, Printing, and Storage Expenses

6 out of 10 finance officials we surveyed said they feel pressure when they see old invoices.

It’s true – piles of invoices in filing cabinets can be an unpleasant sight that no one wants to deal with.

Imagine your office furniture empty, with no past invoices cluttering the space. With digital workflow, you could-

- Eliminate printing, mailing, and storage costs

- Reduce paper usage

- Achieve the company’s environmental goals

- Free up physical space for people instead of paper

This is not limited to efficiency alone; it’s more about transforming the way finance works. Once automated accounts payable takes its place, the finance team can work smoothly, speedily, and strategically.

The infographic below tells the whole story of where automation is possible and works smoothly-

Every technology in the market offers various benefits, but very few of them align with the business strategies. Automation is one among them.

Aligning Accounts Payable Automation with Business Strategy

Automation is a broad and evolving strategy. Limiting it to just automating daily operations and saving costs would not be wise.

Let’s Define the Business Case for Accounts Payable Automation

The pointers below will help finance teams present the story from a strategic angle. A CFO usually thinks from a strategic perspective, so conveying your approach this way would be beneficial.

First, you need to understand the strategic value it carries-

How Accounts Payable Automation has a Strategic Value Beyond Cost Savings?

Applying automation in accounts payable helps you build your growth map. It’s a strategic enabler that allows you to reveal liabilities, work on payment cycles, and unveil working capital positions to plan, implement, and grow.

Strategic Impact

- Ensures accurate forecasting

- Speed up strategic investment decisions

- Backs business growth efforts

How Does Accounts Payable Automation Channelize Hidden Efficiency?

Automation easily identifies late payment penalties, duplicate payments, and increased labor expenses. And they convert these unnoticed inefficiencies into measurable time, cost, and strategic gains.

It’s often said that “Something important can be missed by the human eye, but not by a machine’s eye, because a machine doesn’t assume.”

Strategic Impact

- Strengthens vendor relationships

- Improves compliance & reduces risk

- Enables data-driven decision-making

- Fuels competitive advantage

How Does Accounts Payable Automation Support Scalability and Growth?

As businesses expand their branches to more financial operations, the one constant headache they carry is manual AP processes.

But when automation takes its seat, you can scale seamlessly and support growth initiatives. Interestingly, you don’t need to add more resources like staff or working time.

Hence, you get a scalable backbone that shapes and grows your business by empowering financial agility at every stage of expansion.

Strategic Impact

- Standardizes processes across entities

- Supports global expansion

- Cash flow management

In reality, aligning accounts payable automation with business strategy is a real need for modern organizations.

By doing so, you can demonstrate a broader understanding of the key financial and operational drivers. This approach increases the likelihood that C-suite people would be convinced to use accounts payable automation solutions to make informed decisions.

How to Choose the Best Accounts Payable Automation Company?

Each organization operates uniquely, and every department has its own goals- including finance.

Its major goal is to manage an organization’s financial health and support its strategic objectives. Fortunately, with automation, your team gets a lot of time to walk towards your goal.

What you need is one reliable accounts payable automation partner.

Picking the right partner is no less than choosing technology. To make the correct choice, you must verify each option cautiously.

While purchasing “accounts payable automated solutions,” you must compare the available options across three strategic dimensions-

First is scalability

You need to examine how well the solution manages increasing invoice volume, additional subsidiaries, and more users, ensuring the system doesn’t collapse as you scale.

Check before you buy accounts payable automation-

- Does the solution provider scale invoice volume without loss in performance?

- Are there any extra charges per invoice or module as you grow?

Second is security & compliance

You need to discuss with your shortlisted vendors about the strength of their data protection, audit controls, role-based access, and certifications.

Looking at the secrecy of financial data, you must take into consideration the vendor’s reliability and compliance standards.

Check before you buy accounts payable automation–

Search for various options- SOC 2 ISO/encryption/audit logs/segregation of duties / regulatory compliance (e.g., GDPR)

Third is ROI & financial impact

You must analyze net benefits vs total cost (direct & indirect) charged by the provider. This analysis will help you justify the investment and demonstrate long-term value to the C-suite.

Check before you buy accounts payable automation–

- Are all fees (setup, subscription, transaction-based, add-ons) clearly explained upfront?

Pro Tip 1- “Use standard ROI formula- Net Savings / Total Costs × 100%”

Pro Tip 2- Find answers to all the common questions and confusion about accounts payable services here.

Going forward, finance teams must strategically implement accounts payable automation.

Integrative Systems understands your unique needs to deliver you maximum results. We help you-

- Integrate Automation in Finance Value- We consider automation as a crucial part of the finance team’s core aims to widen its role in efficiency, accuracy, and strategic decision-making.

- Encourage Continuous Process Improvement- We give support for continuous learning and improvement to boost revenue and streamline automated workflows.

- Build a Dedicated Finance Automation Team- We help you create a central team to track performance, lead automation efforts, and maintain traction in AP, AR, and reporting procedures.

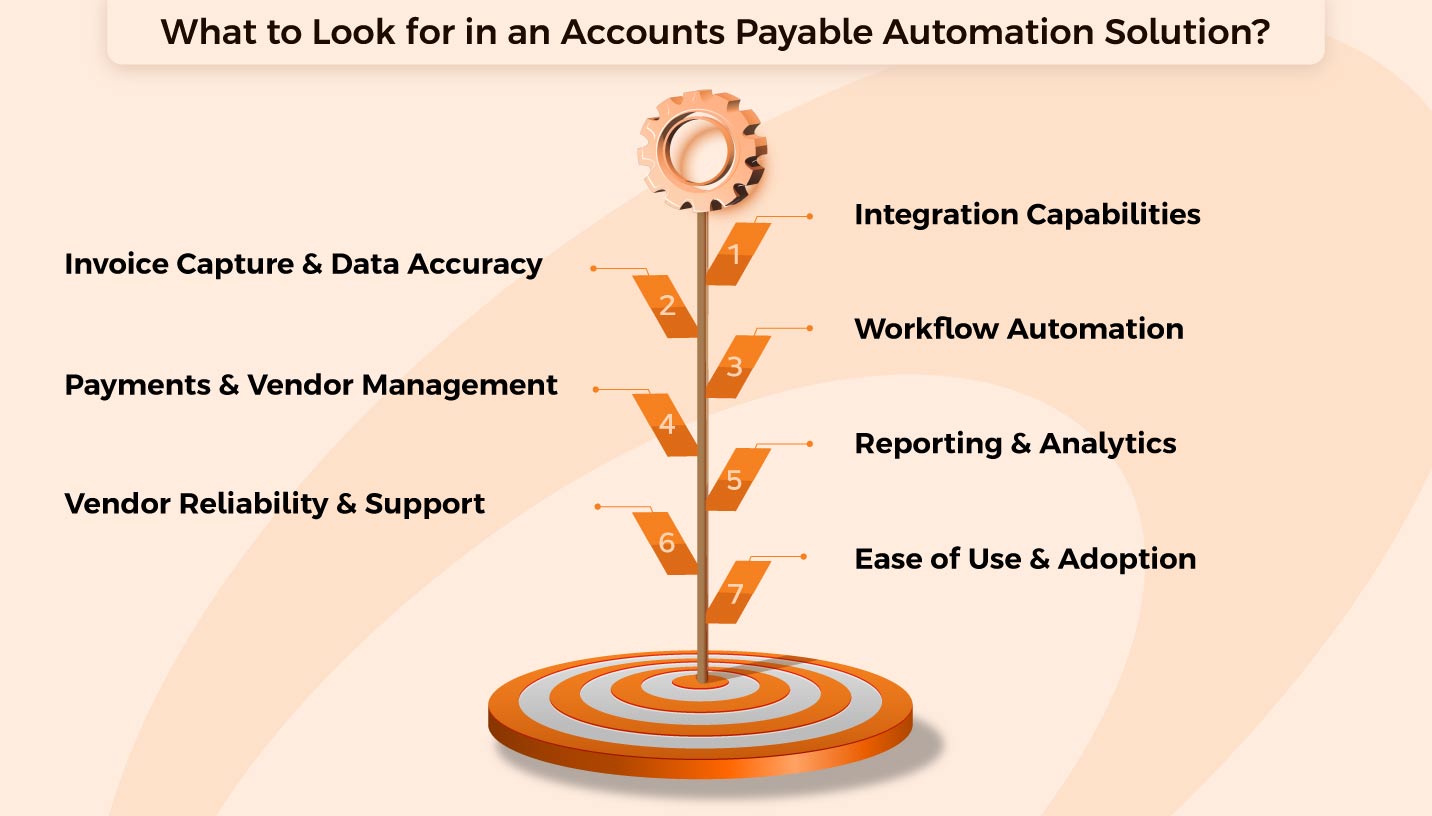

In addition to this, let’s have a look at this infographic before purchasing outsourcing accounts payable automation services.

Your Trusted Place for Reliable Accounts Payable Automation Services

Integrative Systems works as an extension of your team. With a strategic accounts payable automation solution, we support you at every step of your automation journey.

Look at our 3 major value propositions

- We have given 15+ active years to this industry and helped 100+ businesses enhance their process efficiency with our solutions.

- We have experts of varying experience levels from 5 to 15 years, allowing you to choose the right expertise as per your needs. This flexibility has helped clients reduce AP cycle time by up to 60%.

- We are committed to keeping the customers first, maintaining 99% SLA adherence, and providing proactive support throughout the automation journey.

This is just an introduction. We have much more to discuss to speed up your operations as well as outcomes.

We usually start by gathering detailed insights into your financial performance, vendor and customer payment patterns, and trends.

When this data meets our accounts payable services, you can effortlessly pay on time and strengthen relationships with your vendors.

Integrate your workflow with accounts payable automation and see how smoothly you achieve your departmental goals. Feel free to contact us at contact@integrativesystems.com and start your journey to a fully automated experience.

FAQs- You Might not Want to Miss!

What is accounts payable automation?

Ans- It is a process to digitize and streamline accounts payable in an end-to-end manner. It consists of bill capture, approvals, payments, and reconciliation. The finance team can better work with actionable insights, managing time and compliance.

How do you automate an accounts payable process or approval workflow?

Ans- You can frame rules for bill approvals based on amount, vendor, or department. The system automatically routes bills and captures approval/rejection logs, minimizing follow-ups and managing compliance.

Why use accounts payable automation?

Ans- Accounts payable automation takes control of the AP tasks, lowering the risk of human-created errors while processing invoices. If you are looking for a workflow to strengthen vendor relations, empower timely payments, and better AP transparency, then AP automation is a golden way.

What is the future of accounts payable?

Ans- Optical character recognition (OCR) and business rules engines will allow AP departments to significantly minimize repetitive manual work. In the upcoming time, you can expect high-value activities with this workflow.

What are the benefits of accounts payable automation?

Ans- First benefit is internal efficiency. With accounts payable automation, processing time and cost for bills and invoices will be significantly minimized. Also, it reduces the risk of errors and payment delays and strengthens relationships with suppliers. Also, the companies can have better protection against potential fraud.