The clock is touching the after hours, yet the CFOs office still has that hustle-bustle.

A heap of invoices sitting on the table, a bunch of reconciliation files untouched on the computer screen, and a mobile phone buzzing with another vendor calling.

Juggling with accounts payable deadlines, follow ups for receivables, alleviating vendor concerns, and yet ensuring that every transaction aligns – these are not demands but duties.

For finance leaders, it’s not occasional, but regular.

And that’s where back-office services prove pivotal.

Thinnking, “Why resort to back-office services when these chores can be handled in-house?”

It’s understood that these activities are vital. But they become a challenge when senior financial leadership is buried under operational tasks, and the bandwidth for strategic thinking shrinks.

Instead of shaping growth initiatives, the day gets consumed by firefighting – clearing delayed payments, resolving mismatched records, and smoothing over vendor disputes.

This is where our back office optimization services deliver a decisive shift; not as a stopgap measure, but as a reimagined way to run financial operations.

Transform Your Operations with Back Office Optimization Services

Cut costs, improve accuracy, and empower your team.

We move beyond the narrow definition of back-office support services. Our approach integrates Accounts Payable, Accounts Receivable Services, vendor management, reconciliation, and payment processing into one cohesive framework.

The outcome is more than operational relief; it’s financial clarity that fuels smarter, faster decision-making.

Our foundation rests on three principles –

- Precision at Scale – Accuracy that’s consistent, no matter the volume of invoices or reconciliations.

- Technology-led Efficiency – Limited manual dependency with proven processes and intelligent automation.

- Strategic Partnership – We are quick to adapt & pivot to match your operational needs, compliances & industry practices.

Thinking, “What do I gain?”

Streamlined AP approvals + retained vendor trust.

Regularized AR collections + predictable cash flow.

No audit anxiety from incomplete reconciliations + prioritize growth.

In the sections ahead, we’ll explore how structured, expertly delivered back office financial services evolve from a support function into a growth lever; driving agility, resilience, and scalability.

When your back office runs like clockwork, your front office can focus on winning.

How do Back Office Services Transform Operational Accounting?

Traditionally, back office work conjures images of invoice processing or overdue payment follow-ups.

But today’s financial backbone extends far beyond Accounts Payable and Accounts Receivable Services.

Modern back office functions act as the financial control hub; balancing transactional execution with forward-looking oversight.

Alongside AP and AR, they include financial planning and analysis (FP&A), reconciliation, vendor coordination, audit preparation, and payment processing services that ensure every financial movement is compliant, secure, and on time.

It’s no more about “bookkeeping”

It’s about creating a tech-powered ecosystem. A system where data flows like water, compliance worries are forbidden, and decisions are made with real-time data.

And that’s very much possible with an ideal back office financial services provider. They help you locate & eradicate shortcomings of your finance function and lead you toward growth.

Accounts Payable Services

AP is the heartbeat of vendor relationships and cash flow discipline.

We ensure that accounts payable services are proactive, not reactive.

Right from invoice on-boarding & verification to payment processing & vendor relationship management, our AP processes are wired for accuracy & efficiency.

No matter if it’s a single supplier invoice or recurring trail of invoices, we ensure every transaction is processed with the same SOP, on time.

This helps us save you from late fees, foster your vendor relationships, and represent you as a reliable party eligible for better deal negotiations.

Improve Operations with Back Office Optimization Services

Lower expenses, reduce risk, and streamline delivery.

Accounts Receivable Services

AR is more than collections; it’s about securing your revenue pipeline.

Our accounts receivable services focus on both accuracy and responsiveness, ensuring invoices are monitored, payments reconciled, and discrepancies addressed before they impact your balance sheet.

We integrate AP and AR solutions to create a continuous cash flow cycle.

Every receivable is tracked, followed up, and closed with minimal delay leading to reduced Days Sales Outstanding (DSO) and a healthier working capital position.

Financial Planning & Analysis (FP&A)

Financial planning and analysis serve as the growth compass for making informed investment decisions.

Our back office financial services are designed to go beyond mere numbers. We ensure to deliver insights that contribute to your core strategy.

Right from budgeting to forecasting, and variance analysis to performance tracking, we have you covered with our proven FP&A processes.

The goal is to offer you a real-time, 360-degree financial view.

Our FP&A models align with your operational accounting needs and strategic objectives alike. This helps us enable predictable cash flow and profitability.

The result? You are empowered to make every financial decision with confidence backed by proven financial frameworks.

Payment Processing

Today, payment processing extends well beyond issuing checks.

We manage everything right from wire transfers, ACH payments, automated payment cycles, for the matter even physical cheques. We ensure that we keep our processes in line with banking regulations & security policies.

We automate authorizations & reconciliations. This helps us minimize manual errors, upkeep the speed of transactions, and maintain healthy audit trails.

No matter if we’re processing a local supplier payment or initiating a multi-currency transfer, our proven processes ensure we move with utmost care, speed, and accuracy.

When combined, these back office support services form a connected ecosystem; where AP, AR, and payment processing work in sync as levers for agility and growth.

Improve Operations with Back Office Optimization Services

Lower expenses, reduce risk, and streamline delivery.

Why Should You Consider Back Office Outsourcing Services?

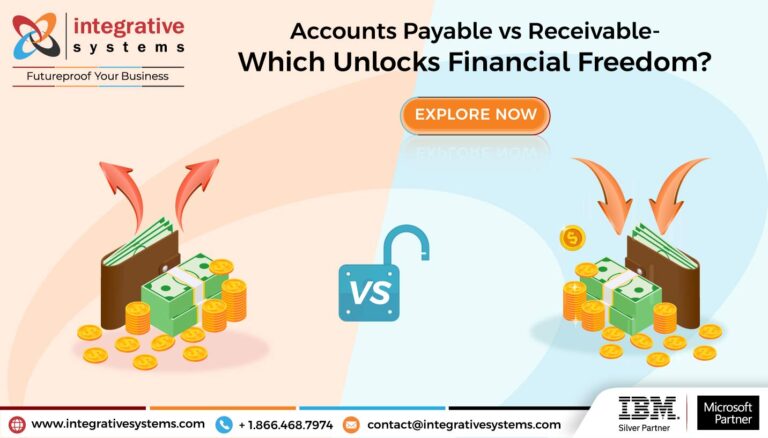

Even progressive companies face the drag of back-office bottlenecks. Manual processes build up, minor errors snowball into disputes, and valuable staff spend time firefighting instead of driving strategy.

Without optimized financial operations, these inefficiencies chip away at profit margins and vendor confidence. And in a fast-paced digital marketplace, slow cycles can mean lost opportunities.

The Hidden Costs of Manual Invoice Entry

Manual data entry seems attainable for low volumes. But as you grow, it becomes counterproductive for your teams.

What once worked wonders now becomes a home for errors, redundancies, and misplaced records inviting rework, delayed payments, and strained supplier relationships.

Working with an accounts payable services provider puts you at an advantage. They help you automate invoice matching, eradicate duplicity risks.

While the extended team of AP experts handles the routine tasks, your in-house finance team can focus on high-value tasks like nurturing supplier relationships.

Delayed Payments and Cash Flow Strain

Late payments are often process failures, not cash shortages. Inefficient approvals or processing delays risk penalties and weaken vendor trust.

With an experienced invoice reconciliation service provider, payment readiness becomes predictable.

They help you automate reminders, integrate workflows, and keep every transaction on schedule. Payment reconciliation services are focused on protecting your cash flow & reputation.

Reconciliation Backlogs That Cloud Decisions

When accounts receivable reconciliation or AP reconciliation lags, leadership loses real-time financial visibility. Forecasting turns into guesswork, and working capital opportunities slip by.

Specialized AP & AR solutions make reconciliation an ongoing process, with transactions matched, variances flagged, and exceptions resolved continuously; delivering reliable, up-to-date financial intelligence.

Vendor Disputes That Drain Resources

A single vendor payment missed can expose you to bigger risks. Errands of communication, internal looks ups, escalations and whatnot!

A structured approach to vendor payment dispute resolution helps you save time, money, and ultimately your reputation. Right from document trail handling to payment timelines, from communication to issue resolution – everything is handled right before it turns into an escalation.

Why Outsourcing Back Office Services is a Strategic Move?

Outsourcing Back Office Services is about more than saving costs.

By partnering with a specialized invoice reconciliation service provider or outsourcing accounts receivable services, you gain –

- Consistent execution without reliance on internal resource capacity

- Scalable, technology-driven workflows that grow with demand

- Reduced cycle times, fewer disputes, and cleaner reconciliations

- Freed internal bandwidth to focus on revenue-driving priorities

With Integrative Systems, outsourcing transforms your back office from a reactive function into a proactive engine for efficiency and growth – serving as a strategic extension of your finance team.

Improve Operations with Back Office Optimization Services

Lower expenses, reduce risk, and streamline delivery.

Integrative Systems AP & AR Solutions in Action

The true test of Accounts Payable and Accounts Receivable Services isn’t in the process diagrams; it’s in the day-to-day realities.

When deadlines collide, vendors demand answers, and finance teams juggle competing priorities, the strength of your AP & AR framework becomes evident.

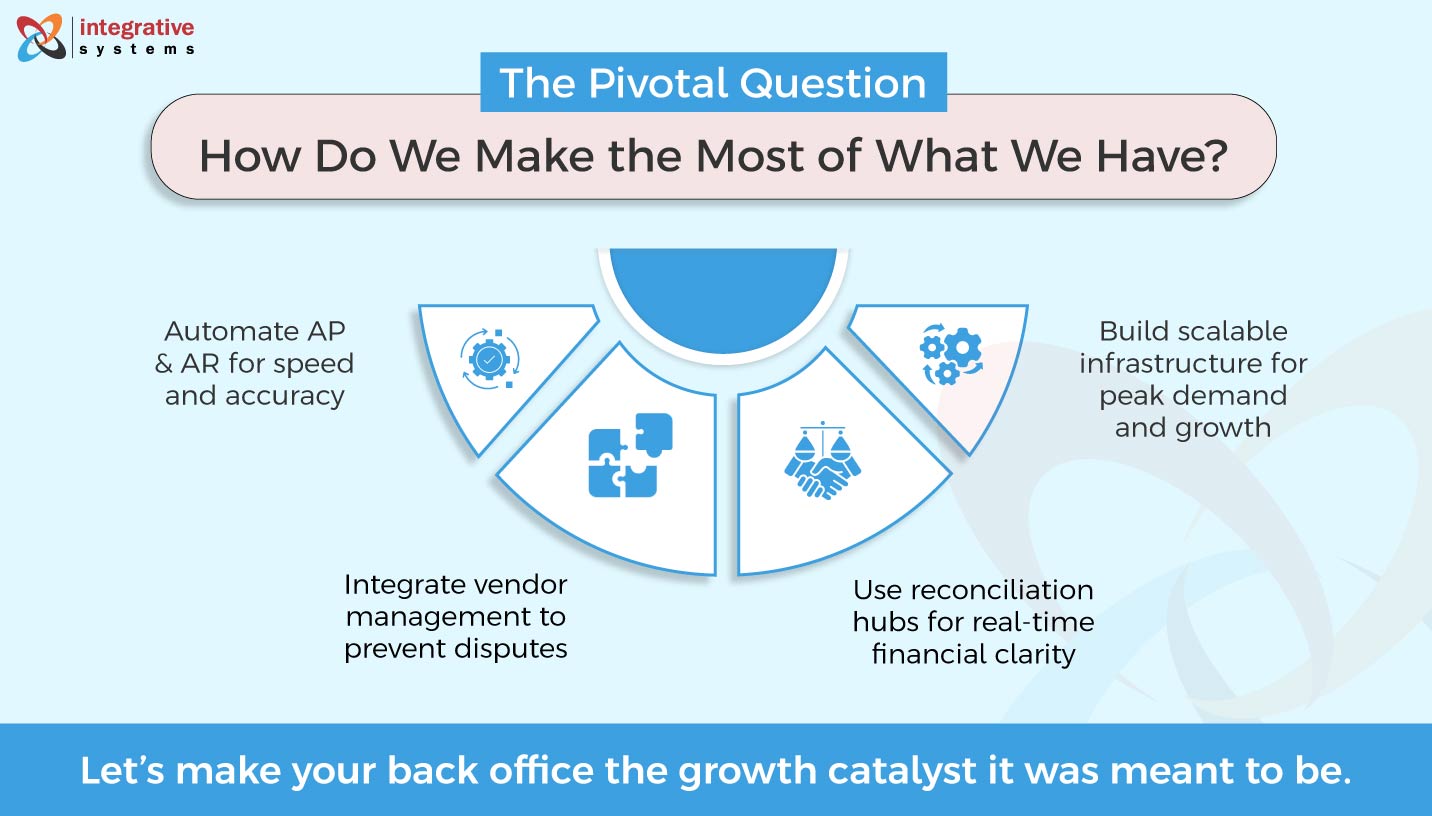

Thinking, “How do we make it different?”

Our approach is our biggest differentiator. In plain words – we believe in a strategic partnership and never deliver AP & AR solutions as isolated transactions.

When we say a strategic partnership, we’re responsible to help you succeed with your AP & AR function. Thus, we’ve designed the Shared Outcome Model.

Shared Outcome Model runs on a collaborative approach where our team of AP & AR experts work closely with you to map your performance goals with operational capabilities. This ensures frictionless execution, complete transparency, and resilience against disruption.

Here’s how our expertise has turned real-world financial challenges into measurable wins.

Case 1 – Vendor Payment Disputes

The Challenge

A mid-sized manufacturing firm was running into repeated vendor disputes.

Purchase order mismatches and delayed data reconciliations were worsening the problem.

The vendor relations were exposed to mistrust, so bad that every such incident would translate into lengthy email threads, long phone calls, and inter-department cross-checks.

Senior finance leaders were burning their valuable time in resolving the disputes, set aside strategic initiatives. Over time, these disputes slowed supply chain deliveries and strained high-value supplier relationships.

Here’s What We Did

We implemented a structured vendor payment dispute resolution workflow.

This centralized all documentation, introduced automated discrepancy checks, and established a clear escalation matrix.

By embedding accounts payable reconciliation into the process, variances were identified and flagged before vendors raised concerns. Customized dashboards for procurement and finance teams provided a single, unified view of payment status.

The Outcome

Within six months, dispute resolution time fell by 60%. Vendor satisfaction improved, contract negotiations became smoother, and supply chain efficiency was restored.

Most importantly, finance leaders regained the capacity to focus on supplier strategy instead of operational firefighting.

Improve Operations with Back Office Optimization Services

Lower expenses, reduce risk, and streamline delivery.

Case 2 – Accounts Receivable Reconciliation Upgrade

The Challenge

A professional services organization was running into consistent delays with monthly accounts receivable reconciliations.

Manual matching of cross-system entries was creating discrepancies. And those would remain unresolved for weeks, which would delay the revenue reporting, leading to delayed cash flow forecasts.

Without accurate outstanding balance data, collections teams lacked the insight to act effectively.

Here’s What We Did

We transitioned the client to a outsourcing accounts receivable services model blending automation with specialist oversight.

Transactions from bank feeds, ERP entries, and payment gateways were matched daily. Variances were flagged instantly for review, while reconciled data fed directly into real-time reporting dashboards for finance and collections teams.

The Outcome

Month-end close time dropped by 40%.

Collections performance improved by 25% thanks to instant access to up-to-date receivables.

As the CFO put it, “For the first time, we have complete financial visibility without waiting for the books to close.”

Improve Operations with Back Office Optimization Services

Lower expenses, reduce risk, and streamline delivery.

Case 3 – Automating Payment Processing Services

The Challenge

A retailer was struggling to upkeep with wire transfers, cheque encashments, and ACH transactions over seasonal peaks.

Manual verification and approvals were the culprits causing bottlenecks. This whole scenario was leading to late fees, dissatisfied vendors, and loss of early-payment incentives.

Here’s What We Did

We redesigned their payment processing services using automation. ACH and wire transactions were auto-validated against purchase orders, digital approval rules replaced manual sign-offs, and exception handling was prioritized for high-value payments.

The system was built to scale, enabling peak-season volumes to be processed without adding headcount.

The Outcome

Payment cycle time decreased by 55%, early-payment discount capture rose by 18%, and vendors reported a marked improvement in on-time payments.

Seasonal transaction spikes no longer strained internal resources.

Improve Operations with Back Office Optimization Services

Lower expenses, reduce risk, and streamline delivery.

Core Pillars of Our Back Office Support Services

The strength of Integrative Systems’ back-office operations lies in creating ecosystems that run efficiently in the background; freeing finance leaders to focus on strategy instead of transactions.

We’ve built our core pillars such that they scale with your evolving business needs and integrate effortlessly with your existing workflows.

Whether it’s managing vendor relationships, handling general accounting, or financial planning; everything is done with utmost care, precision, and transparency.

Vendor Management Workflows that Build Stronger Partnerships

We understand what vendor management goes beyond sheer invoice processing. It’s more about building trust, attaining compliance needs, and establishing an environment for mutual value exchange.

We follow a structured approach to vendor management. Our workflow covers everything from vendor on-boarding to contract management and payment scheduling to performance tracking.

And the best part? These workflows can effortlessly be integrated into ERP platforms. NetSuite, QuickBooks, SAP – you name it and it’s done. This ensures that you vendor data is consistent across finance functions.

With our vendor payment dispute resolution prowess, backed by accounts payable reconciliation, we help you catch payment discrepancies well in time, streamline communication channels, and expedite issue resolution.

This keeps your supply chains smooth and reinforces your reputation as a dependable partner.

Reconciliation Hubs – Bank, Intercompany, Vendor

Closing books quickly without sacrificing accuracy is the hallmark of a high-functioning finance operation.

Our reconciliation hubs make that possible.

We consolidate payment reconciliation services across three dimensions into a single, verified source of truth –

- Bank Reconciliation – Matching bank statements and recorded transactions daily, ensures payment discrepancies are addressed in time.

- Intercompany Reconciliation – Automating balance alignment across business units reduces the burden of manual corrections.

- Vendor Reconciliation – Matching vendor ledgers and AP records ensures distance from disputes and prepares you for clean audits.

With this centralization, clients remove reconciliation backlogs, gain real-time balance visibility, and reduce audit prep time.

Improve Operations with Back Office Optimization Services

Lower expenses, reduce risk, and streamline delivery.

General Accounting & Forward-Looking Financial Planning

Our role extends beyond AP and AR into general accounting and FP&A covering budgeting, forecasting, and P&L reporting that provide the strategic lens leaders need to navigate growth.

Our AP & AR experts ensure every entry in your financial data is accurate, supported by well-defined accounts payable reconciliation and accounts receivable reconciliation procedures.

Daily reconciliations across bank, vendor, customer, and inter-company accounts translate into reliable revenue forecasts, enabling confident budget allocations.

We streamline vendor and customer transactions through portals, Outlook, and EDI integrations, ensuring data consistency across all touchpoints. Payroll management, including expense processing and reporting, is handled with precision to keep both compliance and employee satisfaction in check.

From month-end accruals and provisions to rolling forecasts and scenario-based budgeting, we equip you with the agility to adapt to market conditions; whether it’s a quarterly pivot or executing a multi-year growth strategy.

Resourcing & Customer Service as Differentiators

An often-overlooked value of our back office outsourcing services is how we structure teams and service delivery.

We provide extended coverage to support multiple time zones; ideal for global operations.

Our “no single point of failure” staffing model spreads process knowledge across teams, ensuring continuity even if resources change.

Every workflow is fully documented, and team members are trained on your specific ERP; whether SAP, NetSuite, QuickBooks, or custom platforms; ensuring tool-proficiency from day one and seamless integration with your systems.

Why do these Pillars Matter?

Individually, these pillars strengthen core processes.

Together, they create an operational backbone where –

- A resilient resourcing model ensures 24×7 continuity

- Reconciliation hubs keep financial data audit-ready

- Vendor management keeps supply chains steady

- FP&A turns that data into actionable strategy

We see back office services as more than a cost line; they’re a driver of financial clarity, operational resilience, and competitive edge.

From payment processing services to our capabilities as an invoice reconciliation service provider, every function is built to deliver measurable value.

Improve Operations with Back Office Optimization Services

Lower expenses, reduce risk, and streamline delivery.

Infrastructure That Powers Sustainable Performance

Operational excellence is never the result of isolated wins; it’s the outcome of consistent, dependable delivery supported by an infrastructure that scales effortlessly.

At Integrative Systems, our Back Office Outsourcing Services are built around what we call the Shared Outcome Model.

Rather than functioning as a distant third-party vendor ticking off tasks, we integrate deeply into your operational ecosystem.

We share accountability for measurable results; whether it’s clearing accounts receivable reconciliation backlogs, resolving vendor payment disputes faster, or enabling a quicker, cleaner month-end close.

This model stands on three essential pillars.

Stability Through Scalable Infrastructure

Our delivery centers and technology frameworks are designed to ensure back office financial services run without interruption; no matter the volume spikes, staff transitions, or shifts in market conditions.

From payment processing services to accounts payable reconciliation, every workflow is engineered to withstand operational pressure without compromising accuracy.

Through detailed process documentation, built-in resourcing redundancy, and digital workflow automation, we remove single points of failure. Cross-trained teams and extended-hour coverage ensure your back office operations remain uninterrupted, even during peak activity cycles.

Sourcing Models That Fit Your Business DNA

Every organization operates differently; so your financial operations should be supported on your terms.

We offer a spectrum of sourcing models; each designed for flexibility and alignment with your goals –

- Flat-Rate Engagements – Fixed monthly costs based on your requirements; let’s say, payment reconciliation or vendor management workflows.

- Project-Based Engagements – Project-based costs depending on your unique objectives; let’s say workflow automation or reconciliation backlog clearance.

- Custom Hybrid Models – Customizable engagement that allows you scale up or down based on changing business needs; let’s say peak seasons or long-term transformation plans.

This adaptability means you can scale your back office support services up or down without renegotiating every change; ensuring agility with uninterrupted service continuity.

Dependability that Inspires Confidence

Back office outsourcing services aren’t simply driven by attaining SLAs. There’s more to it.

You need a trusted back-office services provider who backs you up and is flexible enough to accommodate your changing needs.

Our goal is to serve as a strategic backbone for your back-office functions. We count ourselves as your extended team and focus on anticipating and addressing operational challenges before they impact your workflows.

We ensure your workflows are proactive and distant from disruptions with our rooted expertise in invoice reconciliation, AP & AR solutions, and vendor management.

Right from meeting compliances to prepping for audits, our proven systems strengthen your finance function. We ensure you’re both operationally well-rounded and strategically ready for the future.

When your infrastructure is designed to be resilient, it reflects in your day-to-day operations and foundations a promising future.

Improve Operations with Back Office Optimization Services

Lower expenses, reduce risk, and streamline delivery.

How do You Select the Right Back Office Partner for Growth?

Outsourcing back-office operations isn’t an easy call.

Finding a back-office services provider who aligns with your financial goals, operational challenges, and customer needs; is certainly more strategic than sheer tactical.

The right partner doesn’t limit themselves to process execution & compliance. They pivot and offer you strategic foresight, scale beside your evolving business needs, and prioritize your success.

Thinking, “How do I qualify such a back-office services provider?”

Here’s what you can follow.

Quick Vendor Evaluation Checklist

Comprehensive Financial Coverage

Can they manage the full scope; from accounts payable and accounts receivable services to vendor payment dispute resolution?

Structured SLAs with Scalability

Do they guarantee measurable results while adapting seamlessly to business growth or seasonal spikes?

Audit Readiness & Compliance

Are their processes built to pass internal and external audits without last-minute reconciliations?

Process Automation Expertise

Are they providing automation for redundant workflows? Do they provide workflow optimization to reduce manual processing burden & boost reconciliations?

Key Questions Ask Before Committing

- How will your team integrate with our existing ERP or accounting systems?

- What measures ensure continuity during peak demand or staffing changes?

- Can you share real case studies of improved back office financial services ROI?

- How do you measure success beyond SLA compliance?

If these answers instill confidence, you’ve found a partner who can not only run your back office support services but elevate them into a growth driver.

Improve Operations with Back Office Optimization Services

Lower expenses, reduce risk, and streamline delivery.

Integrative Systems – Back Office Services Provider of Your Choice

In today’s competitive environment, the back office is no longer a silent cost center.

When designed strategically, it becomes a growth enabler; reducing operational friction, speeding up cash flow, and freeing leadership to focus on innovation instead of overdue invoices and unresolved reconciliations.

With Accounts Payable & Receivable Services, automated payment processing, and structured vendor management, outsourcing is no longer about delegating tasks; it’s about transforming your finance function into a scalable, high-performance value engine.

Partnering with an experienced invoice reconciliation service provider means gaining accuracy, compliance, and efficiency that grow with your ambitions.

At Integrative Systems, our Back Office outsourcing services deliver structure, transparency, and resilience. From faster reconciliation cycles to seamless vendor payment automation, we build operational frameworks that shift finance from a supporting role to a strategic one.

It’s time to stop viewing your back office as a cost; and start seeing it as a growth catalyst. Explore our structured outsourcing models and discover how your finance function can fuel your business ambitions.

Drop us a line at contact@integrativesystems.com and our team of AP & AR experts shall drive it from there.

Improve Operations with Back Office Optimization Services

Lower expenses, reduce risk, and streamline delivery.

FAQs

1. What are Back Office Services, and why do businesses outsource them?

Ans – Back-office services are designed to help businesses with core administrative functions like AP & AR, invoice reconciliations, and customer support. Oursourced back office services allow you to save cost, leverage proven processes, and stay focused on growth.

2. What advantages do outsourced accounts receivable services offer?

Ans – In one line, outsourced accounts receivable ensures your inward cash flow is streamlined and predictable. All of this without investing in building an infrastructure & in-house team.

3. Why are payment reconciliation services vital for modern businesses?

Ans – Precisely, payment reconciliation services ensure accurate invoice matching. They help you spot any discrepancies well in time. With reduced discrepancies, human error, and compliance issues, they help you attain financial integrity.

4. When should you consider vendor payment dispute resolution services?

Ans – Especially when you’re entering conflicting situations over supplier payments due to invoice mismatch, errors, and delayed processing; it’s ideal to consider vendor payment dispute resolution services.

5. How do back office outsourcing services integrate with our existing workflows?

Ans – We follow a simple, streamlined approach where our team inspects and analyzes your existing system & processes. As a part of our shared outcome model, our team works as an extension of your team, follows your operational preferences, ensuring no to low disruption and a swift transition.

6. Can you handle seasonal or fluctuating workloads?

Ans – Absolutely! Our shared outcome model is designed in such a manner that the teams can be scaled up and down as per your changing business needs. Based on your workload, we can quickly ramp up teams of size them down without compromising on productivity or quality.