A manufacturing plant’s primary aim is to produce high-quality products efficiently.

To achieve it, numerous production and machining equipment, like CNC Machines, Lathes, Milling Machines, Laser Cutters, and 3D printers, work in the background.

Interestingly, these supporting tools are purchased from hundreds of vendors every month. Now consider the monthly transaction volume, invoices, and purchase orders processed.

Undoubtedly, they are extensive, leaving no room for any mistakes.

Therefore, accounts payable outsourcing for the manufacturing industry is the safest middle ground.

AP for manufacturing works as a guardian of cash flow

- It boosts supplier relationships

- It improves cost control

- It provides real-time visibility into spend

- It looks into compliance and audit readiness

Finally, it enhances operational efficiency

The role and scope of accounts payable outsourcing for the manufacturing industry are wide. Let’s first understand them to boost cash flow efficiency and secure profitability.

Accounts Payable – Hidden Engine of Cash Flow in Manufacturing

Global supply chains, just-in-time inventory, and complex vendor networks are the elements of modern marketing ecosystems. What you need to have is financial precision to run manufacturing operations smoothly.

If your current manufacturing scenario looks like this-

- Growing volume

- Tight margins

- Need for on-time material

Then you have one effective solution- Strategic accounts payable.

Clearly, an accounts payable specialist for the marketing industry looks after 3 major things-

- Safeguarding working capital

- Maintaining supplier relationships

- Backing production continuity

Breathing New Life into Manufacturing Finance Processes

See the detailed process where accounts payable outsourcing services transform challenges into high-impact opportunities.

1. Manual invoice processing into expert-driven invoice processing

With AP outsourcing services, you can level up from manual processing to expert-led invoice handling. You’ll get benefits like automated invoice processing, payment validation checks, costing accuracy, and timely supplier payments.

Results- It shields your profit margin and protects supplier trust

2. Growing vendor invoice volume into improved efficiency

Accounts payable outsourcing services consider multiple suppliers from multiple locations. May it be raw products, tools, services, or anything with different invoice formats, conditions, and rebate structures. Experts help you match everything accurately with purchase orders and goods receipts.

Results- It makes your process super-efficient and reliable.

3. Data inefficiencies & exception handling into a streamlined process

Experts match three major elements- purchase orders, goods receipts, and invoices from suppliers. The accurate investigation into quantity, cost, delivery date, or other factors makes your process more optimized and reliable.

Results – It speeds up approval time and reveals correct cash positions.

4. Limited cash flow visibility into real-time insights

With near-real-time accounts payable reporting, experts help decision makers to find

- Where money is committed

- Where discounts can be captured

- where supplier risk sits

Results – It channelizes informed decision-making.

Accounts payable for manufacturing is no longer an administrative process, but a strategic process where your revenue can be created, protected, and boosted.

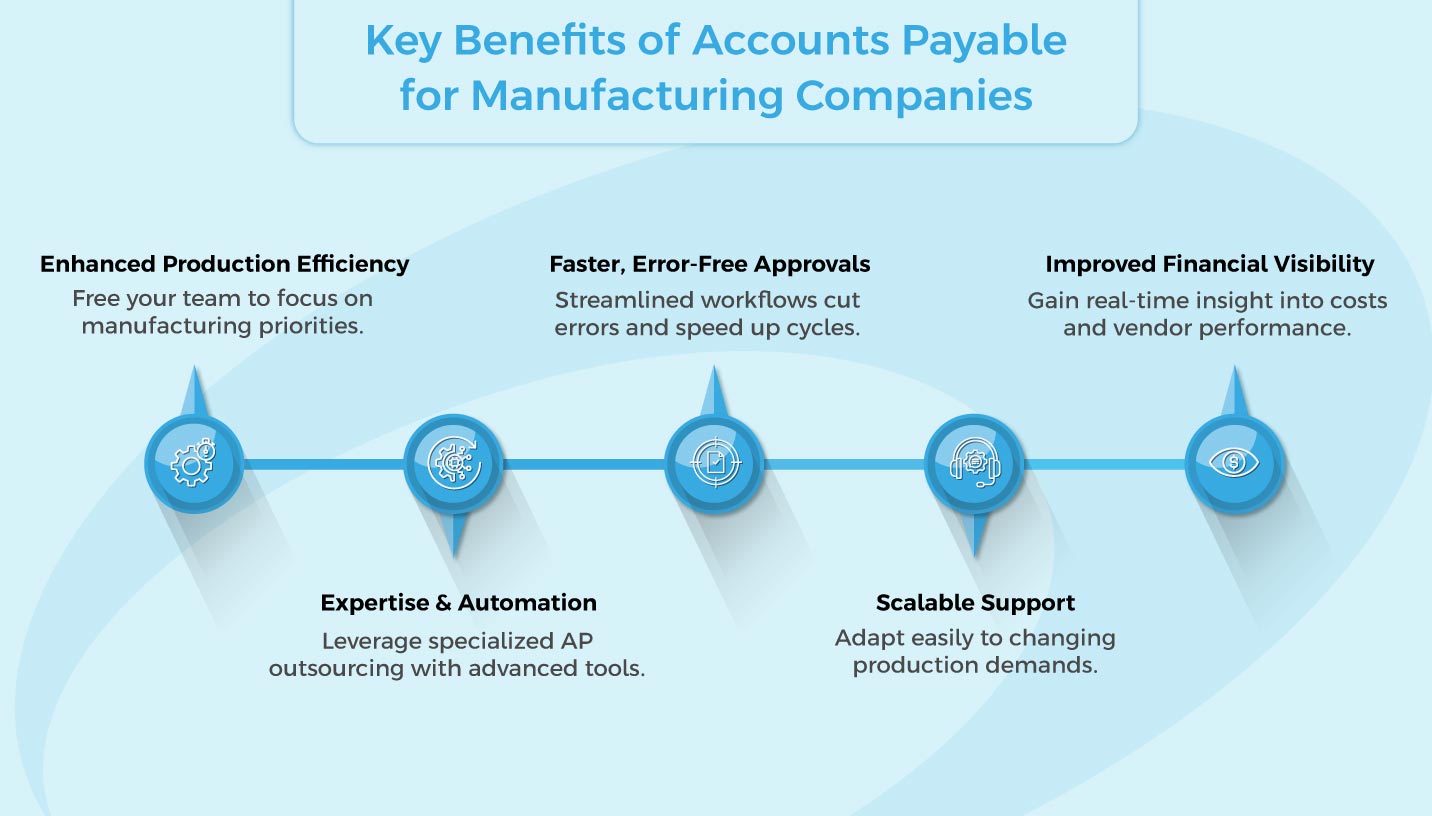

Not convinced? See the infographics below to understand the immense benefits and then consider outsourcing.

Why Outsource Accounts Payable Services for the Manufacturing Industry?

Manufacturing plants need “Timely materials + Reliable suppliers + Predictable cash flow” to become successful.

Only expert accounts payable services can fulfill this need by

- Verifying invoices

- Protecting margins

- Preserving supplier relationships

- Unlocking working capital

Accounts payable providers generally fall under two types-

First type- A specialist provider that handles the full or partial accounts payable process, as per your business needs. It includes invoice capture, PO/invoice matching, supplier onboarding, approvals, payment execution, and reconciliation.

Second Type- A modern provider that works as an extension of your team. They use newer technologies like OCR/IDP, PO matching, RPA, ERP integrations, and payables platforms. As a result, manufacturers get digitized and efficient operational processes.

Business Value- Why Manufacturing Leaders Choose Outsourced AP?

The answer is simple. For quicker invoice processing & lower exceptions.

- Expert teams manage accounts payable processes in a more streamlined way. With expertise and smart strategies, you can accelerate approval cycles and maintain vendor relationships.

- Outsourced accounts payable helps you uncover early-payment discounts, follow consistent terms, and plan payment schedules to manage working capital and cash flows.

- AP experts look at 360 degrees into staffing and training for AP processes. Businesses can use the hiring and training time for more strategic work. Additionally, they easily handle workload during seasonal peaks, relieving businesses from operational costs and headcount pressure.

- Experts implement standard controls, fraud monitoring, and distributed accountability to create a safe path and build stronger controls.

An accounts payable specialist carefully plans and executes processes for big companies that have

Multiple manufacturing plants OR

Multiple business units or legal entities OR

Operate in multiple locations or currencies.

Finally, your business gets full-fledged access to the various services that manipulate the market.

Cost Comparison – In-house vs Outsourced AP

Before outsourcing accounts payable for the manufacturing industry, you should look at this table for clarity on every factor involved.

Cost-bucket | Outsourced Accounts Payable | In-house Accounts Payable |

Employees | Provider handles staffing, training, and hiring | You need to pay staffing, training, and hiring expenses |

Technology

| Included in provider fees. They provide advanced tools | You need to pay for investment, maintenance, upgrades, and the licence fee |

Office & Overhead

| Lower internal footprint, provider infrastructure is there | Need a physical workplace and hardware |

Dispute and exception handling

| Provider handles every dispute and applies the resolutions | You need to spend time fixing disputes |

Cost Behavior

| Predictable pricing, efficiency grows | Cost fluctuates as invoice volume grows |

Scalability options

| Limited scalability to handle peak seasons | Manage multiple locations, various plants, and rising volume |

Outsourcing AP is not a luxury service but a strategic roadmap that drives you to endless success and saves you money. See the infographics below for more clarity.

Accounts Payable in Manufacturing- A Proven Success Case Study

A giant manufacturing company operating multiple plants was partnering with multiple vendors and handling a complex supply chain.

The finance team of the company was struggling with the AP process. See the scenario of the accounts payable team was experiencing-

- The team was fully loaded with the manual invoice

- The team was chasing approvals and payments

- The team’s time was compromised on low-value tasks

- The team’s productivity and vendor relationships were suffering

Challenges

Other than the AP team, the whole finance department and the manufacturing company were facing below challenges-

- They were facing a continuous risk of human errors, duplicate payments, and false entries.

- They were facing paper-based workflows and storage/printing overheads.

- They were facing visibility issues with cash outflows and vendor performance.

- They were facing scalability issues related to the AP function across plants/entities.

- The above issues were disturbing everything from supplier reliability to production schedules.

Solution

The company collaborated with an accounts payable outsourcing company. And adopted a powerful approach- People + Process + Technology

- Expert implemented automatic capture of invoices through OCR/data capture

- Expert followed automated routing of invoices for approval based on business rules

- Expert scheduled payment execution and reconciliation

- Expert standardized workflows across facilities, entities, and currencies

- Expert utilized real-time dashboards to track outstanding liabilities, vendor status, and cash flow

Outcomes & Benefits

- They achieved reduced processing cost per invoice.

- They reduced the risk of overpayments, duplicate payments, and errors with automated validations and built-in controls.

- They experienced reduced costs on paper, printing, and storage.

- Finance leadership gained real-time insights to make better and informed decisions.

- They experienced efficiency in handling additional plant volumes, more vendors, and new entities.

In this way, outsourcing accounts payable for the manufacturing industry empowers you to be in the first position to follow any significant trend that manipulates the market.

Accounts Payable Outsourcing for The Manufacturing Industry- Future Trends

Manufacturing companies face global competition, complexity in the supply chain, and scaling with digital transformation.

Challenges are endless, but strategic solutions are few.

Accounts payable are one of the powerful solutions that need your serious attention.

Consider upcoming trends in accounts payable to get a good grasp of this powerful solution.

Trend 1- The Rise of Intense Automation in AP Workflows

Manufacturing operations demand consideration of invoice volume, multiple suppliers, growing PO matching, and plant management.

These various requirements are challenging to fulfill with manual efforts, paving the way for automation.

What will change with automation?

- Automation in AP workflows will optimize the way invoices are captured, reduce manual mistakes, and finally provide abundant time to the finance team for strategic work.

- Modern automation in AP helps manufacturers handle both PO and non-PO workflows, empowering them to achieve effective resource utilization and improved visibility into cash flow.

Market experts say, if AI is applied successfully, AP teams can experience benefits such as-

- AI-powered data capture (OCR/IDP)

- Automated matching

- Smart approval workflows

- Decision-support tools

For manufacturers operating multiple plants or global supplier bases, automation will accelerate the whole process.

Automation > faster processing > fewer exceptions > stronger vendor relationships.

Trend 2- Predictive Analytics & Smart Dashboards will Deliver Better Financial Insight

Automation combined with predictive analytics and smart dashboards will boost financial insights.

As routine tasks will be streamlined by automation, undoubtedly predictive analytics and dashboards will provide an extra layer on top of the AP process.

These analytics tools provide manufacturing finance teams with-

- Real-time visibility into payment obligations

- Vendor performance

- Aging payables

- Cash-flow trends

In manufacturing, real-time visibility in cash flows is significant. Because, as a leader, you must decide various things related to production planning and inventory management.

This trend will help manufacturing companies unlock the way for vendor relationships.

Trend 3- Manufacturing Companies will Adopt Cloud-based AP Management

In the coming years, manufacturing companies will reap benefits from cloud-based AP management.

The major benefit will be “streamlined integration with global operations.”

A cloud accounts payable platform can scale a growing manufacturing company that has multiple plants, entities, currencies, or supplier locations.

The interesting part is- There will be no need for wider on-premises infrastructure.

In the future, outsourcing providers with cloud-based AP platforms will-

- Offer scaled-up services across geographies

- Manage major surges in volume

- Back up multi-entity operations

This trend is very crucial for the manufacturing industry, as a cloud-based accounts payable platform will support growth at peak times.

Trend 4- Sustainability & Paperless Processing Will Take Its Place in Financial Operations

Manufacturing companies try to convert most of their processes into sustainability.

Imagine if financial processes also became sustainable.

In the near future, paperless AP processes will be the new driving force, offering-

- Low or no paper usage

- Uninterrupted and timely deliveries

- Better auditability, compliance, and traceability

Additionally, digital accounts payable systems will leave no room for missed invoices.

Tracked invoices > Faster approvals > No more errors

Additional benefits would be better tracking of supplier performance, payment impact, and better process efficiency.

Why These Trends Matter for Manufacturing

Manufacturing companies need digital support in place of manual processes to achieve enterprise goals.

Paybacks – “environmental + procedural + strategic”

See the bigger picture-

- Manufacturing companies will have operational alignment

- Manufacturing companies could better control cash & its flow

- Manufacturing companies could easily handle global & multi‐site complexity

- Manufacturing companies will have strategic supplier relationships

Future-ready Manufacturing Ecosystem with Accounts Payable Outsourcing Services

Manufacturing has always been the most dedicated and hard-working industry. The significant efforts you make in transforming a raw material into a usable product are commendable.

Integrative Systems salutes your journey and is happy to be a part of it.

Our accounts payable outsourcing services for the manufacturing industry take care of every small and big factor involved in the processes.

As a silver business partner at IBM, we specialize in examining the unique business needs and crafting powerful strategic solutions that work best for your business as well as the industry.

Have a look at the unique at our accounts payable services–

- Invoice processing and management

- Vendor management and communication

- Payment scheduling and execution

- Expense reporting and analysis

- Purchase order management

- Data entry and verification

- Reconciliation of accounts payable records

- Compliance and audit support

- Vendor payment dispute resolution

- Document management and storage

In addition to this, we also provide accounts receivable services to turn every transaction into a success.

We provide three compelling value advantages-

- We bring deep industry expertise and the legacy of trusted delivery.

- We offer comprehensive solutions, leveraging our 15+ years of experience.

- Our actions are directly connected with customers, as we are a customer-first organization.

Create a successful path for your manufacturing industry with accounts payable outsourcing services. Conatct@integrativesystems.com and turn every payment into an asset. Our representative will contact you within 2 working days.

FAQs on Accounts Payable for Manufacturing Industry

1. What is the accounts payable process in manufacturing?

Ans- The accounts payable process in manufacturing onboards suppliers and vendors selling parts and supplies for product manufacturing and business operations, processes supplier invoices for payments, and makes global payments in large batches.

2. How do AP outsourcing companies benefit businesses?

Ans- AP outsourcing companies, like expertise accelerated, help businesses streamline their accounts payable processes, reduce operational costs, improve accuracy and compliance, enhance vendor relationships, and free up internal resources to focus on core activities.

3. What kind of cost savings can we expect from your accounts payable outsourcing solutions?

Ans- You can expect significant cost savings (up to 60%) by leveraging our expertise and streamlined processes. Our accounts payables services reduce overhead expenses associated with staffing, training, and infrastructure while also minimizing errors and late payments, resulting in improved bottom-line profitability.

4. Can you support multi-location or international vendor payments?

Ans- Absolutely. We manage AP for companies with distributed teams and international vendor networks. Our workflows are designed for scalability and global reach.

5. Why is accounts payable important for manufacturing companies?

Ans- Accounts payable ensures timely vendor payments, steady access to raw materials, and smooth production. It helps maintain strong supplier relationships, control costs, and support healthy cash flow.